Fall 2021

Welcome to Manufacturing Updates, Pullman & Comley’s quarterly publication that summarizes important legal developments for manufacturers. Manufacturing Updates brings together insights from attorneys across our many practice areas serving the manufacturing sector, covering topics ranging from the laws governing employee health and safety, to renewable energy and environmental concerns, to negotiating protections in your contracts that safeguard your future business.

As we emerge from the pandemic and take on the challenges and opportunities of our next normal, we look forward to continuing to be a resource to you. If you have questions on any of the issues covered in this newsletter, or any other legal topics, we invite you to contact us directly. To sign up to receive this newsletter by email, please click here.

In this Fall 2021 issue of Manufacturing Updates, we cover…

Balancing the Vaccination Equation: Frequently Asked Questions About COVID-19 Vaccines in the Workplace.

Answers to some of the most frequently asked questions we receive from manufacturers about the COVID-19 vaccine.

An Overview of Data Privacy and Protection Laws for Manufacturers.

Understand where your sensitive data exists and how to protect it.

Upcoming 2021 Municipal Revaluations in Connecticut & Other Important Property Tax Deadlines for Manufacturers.

Import information for you to consider if your facility is located in one of the 40 municipalities undergoing a 2021 revaluation.

What Commercial Borrowers Need to Know About LIBOR Sunset, SOFR, BSBY and AMERIBOR.

With only three months remaining until the first transition, here's what you need to know about LIBOR replacements and steps you need to take now.

Responding to EPA or State Environmental Investigations.

Follow this list of 20 procedures to ensure an inspector receives the correct information and minimizes disruption to your facility.

Balancing the Vaccination Equation: Frequently Asked Questions About COVID-19 Vaccines in the Workplace by Zachary T. Zeid

Below are some of the most frequently asked questions we receive from manufacturers about the COVID-19 vaccine.

Q1: What Does It Mean to Be “Fully Vaccinated”?

A1: According to the CDC, an individual is considered “fully vaccinated” fourteen (14) days after receiving the second dose in a two-dose series, such as the Pfizer or Moderna vaccines, or fourteen (14) days after a single-dose vaccine, such as the Johnson & Johnson vaccine.

Q2: Are Companies Permitted to Ask Employees if They Have Been Vaccinated?

A2: Yes. Companies may legally ask employees if they are fully vaccinated to further assist in protecting the health and safety of their employees and the workplace. However, questions should be phrased to elicit a “yes” or “no” response as to whether an individual is vaccinated. Inquiries about “why” an individual is not vaccinated should generally be avoided as that inquiry requires that certain legal safeguards be followed.

Q3: Must Information About Employee Vaccination Status Be Kept Confidential?

A3: Yes. The Americans with Disabilities Act (“ADA”) requires an employer to maintain the confidentiality of employee medical information, such as documentation or other confirmation of COVID-19 vaccination.

Q4: May Companies Require Employees to be Vaccinated For COVID-19?

A4: Yes. An employer may require employees physically entering the workplace to be vaccinated for COVID-19. However, Title VII of the Civil Rights Act of 1964 and the ADA require an employer to provide reasonable accommodations for employees who, because of a disability or a sincerely held religious belief, practice, or observance, are unable to get vaccinated for COVID-19, unless providing an accommodation would pose an undue hardship on the employer. If an employee requests an exemption from a mandatory vaccination policy, the employer should begin the interactive process to determine if the facts and circumstances warrant a reasonable accommodation, and if so, what that accommodation should be. Employers may request information corroborating an employees’ need for an exemption and may discipline employees who provide false or misleading information as part of a request for accommodation.

Q5: How is a Mandatory Vaccination Policy Enforced?

A5: Like other workplace policies, employees who refuse to comply with a mandatory vaccination policy, including those who refuse to receive the vaccine as required without appropriate notice and approval (or exemption) from the employer, can be disciplined, up to and including termination of employment. However, given the current challenges in the labor market, employers should carefully consider their staffing and operational needs prior to implementing a mandatory vaccination policy.

Q6: May Companies Request Proof of Vaccination Status from Employees?

A6: Yes. Companies may request information about employees’ vaccination status, including copies of their vaccination cards. If a company requires employees to be vaccinated for COVID-19, it may require employees to provide proof of vaccination and employees who fail or refuse to provide such proof as required may be disciplined for violating the policy, up to and including termination of employment.

Q7: Should Companies Have a Written Vaccination Policy?

A7: Yes. Employers should have a written vaccination policy even if they are not requiring employee vaccinations. A written vaccination policy is an important resource to communicate information to employees about the vaccine, including your organization’s stance on employee vaccinations, and can provide a useful opportunity to remind employees about their continuing obligations to adhere to COVID-19 health and safety precautions in the workplace.

Q8: Can Companies Require Different Workplace Protocols for Vaccinated and Unvaccinated Employees?

A8: Yes. Unvaccinated employees may be required to comply with different or additional health and safety protocols, including but not limited to daily health screenings, continuous mask wearing, enhanced PPE, and/or periodic diagnostic testing.

Q9: May We to Offer an Incentive to Employees for Getting Vaccinated?

A9: Yes. An employer may offer an incentive to employees to voluntarily provide documentation or other confirmation of vaccination.

Q10: Must We Comply with the New Federal Vaccination Mandates?

A10: It depends. With limited exceptions, employers who are federal contractors or subcontractors are likely subject to the vaccination requirement promulgated by the President’s recent executive order. The President also recently asked the Occupational Safety and Health Administration (OSHA) to create a rule for private businesses with 100 or more employees to require their employees to be vaccinated or undergo weekly testing. Although it has not yet been released, OSHA will be implementing this requirement through issuance of an Emergency Temporary Standard. While it is still unclear exactly what the final rule will look like or when it will be released, employers with 100 or more employees should begin evaluating the necessary logistic and policy changes required to ensure they are prepared to comply should such a requirement become effective.

Please contact a member of our Labor and Employment Department with any questions. Pullman & Comley has policy templates and other useful resources available to assist employers in considering and implementing their options and navigating the web of executive orders, laws, regulations, and other state and federal guidance related to COVID-19. Our attorneys have been working closely with employers to explore and address these types of complex vaccination-related issues and can assist you in determining what type of policy is the best fit for your workplace.

An Overview of Data Privacy and Protection Laws for Manufacturers by Russell F. Anderson

For many manufacturers, data privacy and protection laws may seem like legal concerns that apply to other, more consumer-facing companies. While that may be largely true, given the ubiquitous nature of data, no business can truly escape considering how data privacy and protection laws may apply to them.

Data Breach Notification Laws

Data breach notification laws require businesses to notify affected individuals as well as the State Attorney General’s Office and in certain instances, the media, when unencrypted sensitive data may have been accessed by unauthorized persons. For example, in Connecticut’s data breach notification law, sensitive data includes Social Security numbers, drivers’ license numbers, credit card numbers or financial account information in combination with any required security code or password. In addition, to providing the required notices, Connecticut also requires that the business provide the affected individuals 2 years’ worth of credit monitoring services. As a result, a recent IBM Security Study found that the average cost for data breach response per record lost was $150.

Even if your business is strictly B2B, sensitive data can be squirreled away in various and surprising ways in your systems. Your business likely has the Social Security numbers of your employees for tax reporting. Does your business ever collect Social Security numbers in connection with credit checks? Does your business collect passport information in connection with taking your best customers on a retreat?

Before a ransomware hacker compromises your systems, you should inventory where sensitive data exists and encrypt data that you need to keep and eliminate anything that is extraneous. If you have not purchased a cyberliability policy, this may be a good time to consider doing so.

Data Protection Laws

If your organization or sales efforts are international in scope, baseline data protection laws, such as the European Union’s General Data Protection Regulation (or GDPR) are unavoidable. These laws require businesses to not only post a privacy policy, but also to justify the reasons for collection of any personal data (not just sensitive information) and provide the “data subject” numerous rights regarding the use, retention and disclosure of his/her information. In addition, data transfers between entities (such as between a customer and its vendors) and between countries (especially transfers to the U.S.) must be properly documented. Fines for violation of the GDPR can be as high as 4% of global revenue.

While the United States does not yet have a similar federal privacy law to the GDPR, numerous states have started to adopt their own versions of a “baseline” privacy law. These states currently include California, Virginia and Colorado. Connecticut almost passed its own GDPR-like law at the close of the last legislative session in June.

We would be happy to assist your manufacturing business determine the extent to which these state and international laws apply to you and to assist in your compliance efforts. Please contact Russell F. Anderson or any member of our Intellectual Property and Technology team if you have any questions related to this article.

Upcoming 2021 Municipal Revaluations in Connecticut & Other Important Property Tax Deadlines for Manufacturers by Michael J. Marafito

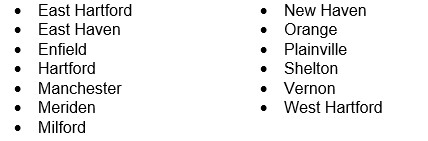

Forty Connecticut municipalities are scheduled to conduct real property revaluations effective October 1, 2021. The following is a partial list of some larger municipalities undergoing a revaluation this year, which are home to a number of manufacturing facilities:

A revaluation notice containing the proposed new assessment of your real property will be mailed in the latter part of this year. The notice usually will include an invitation to attend an informal hearing with the revaluation company or the assessor’s office to discuss the new assessment, which should represent 70 percent of the fair market value of your real estate.

If these discussions do not succeed, the deadline for formally protesting an assessment to a municipality’s board of assessment appeals is February 20, 2022, although some communities may extend the date to March 20, 2022. This protest is required in order to file a Superior Court tax appeal challenging value. Under certain circumstances, a tenant responsible for taxes can file the appeal.

In addition to the upcoming municipal revaluations for real estate, the filing deadline for the annual personal property declarations is November 1, 2021. Manufacturers should keep in mind that certain machinery and equipment used in their manufacturing process may be eligible for an exemption from personal property taxes. To receive an exemption for any qualifying assets, you will need to complete and timely file both a personal property declaration and M-65 form by the November 1st deadline. Declarations and M-65 forms should be available on your municipality’s website.

Should you have any questions or require assistance with any step of the revaluation process, the attorneys and paralegals of Pullman & Comley’s Property Tax and Valuation Department have substantial experience in this field.

What Commercial Borrowers Need to Know About LIBOR Sunset, SOFR, BSBY and AMERIBOR by Brion J. Kirsch

It probably goes without saying, but not all lending indexes are created equally. Each may look at different risks or markets, and not all indexes are “plug and play” for commercial lending transactions. As most have heard by now, LIBOR is set to sunset in phases. The first phase being the discontinuance of the 1-week and 2-month LIBOR rates as of December 31, 2021. The second phase discontinues the 1-month, 3-month, 6-month and 12-month LIBOR rates as of June 30, 2023.

Banks and governmental entities have been feverishly researching various indexes and drafting sample transition language, and as of the end of 2020, it appeared that in the United States the endorsed and most widely used replacement for LIBOR would be the Secured Overnight Financing Rate (SOFR). In recent months, however, many banks and borrowers have begun questioning whether SOFR is the best replacement and have begun looking at other indexes, specifically the Bloomberg Short-Term Bank Yield Index (BSBY) and the American Interbank Offered Rate (AMERIBOR).

These indexes and possible replacements for LIBOR are not the same and are not equal. With only four months remaining until the first transition, listed below are answers to some frequently asked questions to help you understand LIBOR replacements and steps you need to take now.

Question: What are the key criticisms of SOFR?

Answer: SOFR was the early front runner and became the first widely endorsed replacement by large banks, governmental entities, and private market committees empaneled by the Federal Reserve, such as the Alternative Reference Rate Committee. There are, however, a few criticisms of SOFR. First, LIBOR incorporated bank risk; SOFR never will (that is really the point of the secured overnight financing rate – it is a risk-free rate). Second, SOFR is a backward-looking index that is based on the cost of transactions in the market for overnight repurchase agreements. While many banks and regulators preferred this as a LIBOR replacement, many began to question whether a backward-looking index was actually comparable to LIBOR – which is a forward-looking index. The response to those concerns was the creation of “Term SOFR,” a series of forward-looking SOFR benchmarks issued by derivatives-exchange operator CME Group Inc.

Question: Why are BSBY and AMERIBOR attractive options?

Answer: Despite the creation of Term SOFR (which may have other issues including potential mismatches with interest rate swap products and calculations), some smaller national banks as well as community banks kept looking for a more suitable replacement to LIBOR and have largely settled on BSBY and AMERIBOR. Both BSBY and AMERIBOR are unsecured rates (unlike SOFR which is a secured rate) which by definition carry higher levels of risk and therefore tend to generally provide for a higher rate of return. Plainly stated, both BSBY and AMERIBOR will generally be higher indexes than SOFR, however, the increase in the index can be offset by the margin or interest rate spread – which is entirely negotiable. Both BSBY and AMERIBOR are forward-looking rates similar to LIBOR, and both incorporate bank risk but may be subject to greater volatility and may take into consideration a wider range of products to generate the rate. For instance, BSBY takes into account certificates of deposit and wider deposits so that a critical mass is achieved and may not have the term options of LIBOR or SOFR. By comparison, AMERIBOR currently has a 30-day forward-looking rate, but nothing beyond that.

Question: Are other indexes under consideration?

Answer: There are several other alternative indexes being considered by governments, governmental entities, central banks, national banks and community banks. While many lenders and borrowers will “shop” their index by either the lowest monthly payment or the best rate of return, more focus should be paid on the long-term trends and costs associated with a particular replacement index (as well as other factors, such as whether there are any mismatches with the selected index when it is swapped).

Question: What steps should commercial borrowers take now?

Answer: With some of the LIBOR indexes scheduled to cease at the end of 2021, and others remaining on the horizon scheduled to cease as of June 30, 2023, borrowers need to take inventory of their commercial borrowings and determine which, if any, of those borrowings have interest rates that are based in whole or in part on LIBOR. If so, and if the borrower has not started a conversation with its lender (or vice versa) about what will replace the LIBOR based borrowings, now is the time to have those conversations and determine what is the best path forward for both the lender and the borrower. During those conversations, it should be clearly communicated and documented what the alternatives are, what the cost of the alternatives will be to each party and what changes need to be made to the existing loan documents to implement those changes.

Question: What are some areas that borrowers should pay particular attention?

Answer: If any of the borrowings are subject to an interest rate swap, cap, collar or other derivative product, the conversations above need to include what replacement index will go into effect under the derivative product and how that index will compare with the replacement index being offered under the promissory note. Be very careful in this analysis as mismatches of indexes can have very costly results. Additionally, if the commercial borrowing has a LIBOR floor (language in the promissory note stating that LIBOR will never fall below a certain pre-determined threshold), borrowers need to take extra caution to make sure that any spread adjustment, when factored into the new index (which may or may not have a floor of its own) results in the same or substantially the same monthly payment as it did with the LIBOR rate.

The conclusion is that the more options offered to a borrower the better, but you need to be careful and deliberate in your consideration and ultimate selection of a replacement rate as the cost today may not be the cost tomorrow. The attorneys at Pullman & Comley, LLC have extensive experience representing lenders and borrowers and are prepared to assist them with a smooth transition from LIBOR that avoids the potential pitfalls. If you have any questions concerning this article or any related matter, please feel free to contact Brion J. Kirsch at bkirsch@pullcom.com or any other member of Pullman's Commercial Finance practice.

Responding to EPA or State Environmental Investigations by Lee D. Hoffman

Preparation is key in surviving an EPA or state environmental agency inspection. Your facility may have advance warning that the inspector will be visiting, so the disruption caused by the inspection can be minimized, but that is not always the case.

Below is a list of 20 procedures for handling governmental inspections. Following these procedures when an inspector arrives will help ensure that the inspector receives correct information and minimizes the disruption to the facility.

1. Establish an “Inspection Supervisor” to be responsible for all enforcement inspections. It’s important to coordinate all inspections through one responsible individual who is familiar with the rules and comfortable asserting the company’s legal rights.

2. Decide whether and on what terms to allow an inspector access to your facility. If the inspection is a routine matter, the company will want to consent to the inspection. Many environmental permits REQUIRE inspectors to have access to facilities. In those cases, inspectors MUST be granted access. Certain situations will arise when the company will want to assert its rights and deny access to its facilities, however, these decisions should be arrived at carefully and only after full consideration of the situation.

3. Require the inspector to provide credentials.

4. Establish the parameters of the inspection during an opening conference with the inspector. Ask the inspector:

- What is the purpose, cope and anticipated duration of the inspection?

- What does the inspector want to see and why?

- Will documents or samples be requested, and

- Will photographs or video be taken?

5. Never let the inspector conduct the inspection alone.

6. Limit the inspection to those areas specifically requested by the inspector in the opening conference.

7. Do not let the inspector talk to other employees.

8. Do not take the inspector to areas where an upset or other emergency is in progress.

9. Take detailed notes. The inspection supervisor should take detailed notes regarding:

- What the inspector views;

- The questions the inspector asks;

- Other employees with whom the inspection supervisor consults to obtain information and what information is provided to the inspector after the consultation;

- The date, time of day, duration and weather conditions of the inspection, and

- The inspection supervisor's general impressions of the inspection and the inspector's demeanor.

10. Obtain a copy of any form used by the inspector during the inspection.

11. Answer inspectors’ questions only when 100% sure of the answer.

12. Do not show the inspector any documents which are or may be privileged. If the inspector asks to see privileged documents, the inspection supervisor should state that the documents are privileged and that the inspector must submit a written request or produce a search warrant specifically covering the documents he wishes to see.

13. Keep records of everything given to the inspector.

14. Obtain split samples and keep records of all samples taken by the inspector. If the inspector plans on taking samples, the inspection supervisor should indicate that samples will be drawn only by your employees.

15. Record all photographs taken by the inspector and obtain copies. If the inspector takes photographs, the inspection supervisor should note the time, date, place, the subject of the photograph and the photographer’s name.

16. If problems arise and there is a possibility of a criminal violation, stop the inspection and escort the inspector to the lobby to wait until your attorney is contacted.

17. Insist upon a closing conference. If the inspection will continue for more than one day, a conference should be held a the end of each day to discuss the findings.

18. Request a copy of the inspector’s report.

19. Follow up with the inspector after the inspection. Even if the closing conference and the follow-up verification call indicate that no enforcement action will be brought, a company should still implement reasonable suggestions made by an inspector and correct any current violations or problems that may lead to future.

20. If a warrant is presented, notify your supervisors and the company’s attorney immediately.

For additional information regarding how your manufacturing facility should respond to an EPA or state environmental agency inspection, please contact your Pullman & Comley environmental attorney or Lee D. Hoffman at 860-424-4315 or lhoffman@pullcom.com.

Cannabis in Connecticut Webinar on October 6: New Opportunities and Challenges for Businesses, Municipalities and Employers in our Growing Recreational Industry

The legalization of recreational cannabis has opened up an exciting new market in Connecticut. But as with any new industry, there are a host of regulations and legal issues to navigate. Join the attorneys of Pullman & Comley's Cannabis, CBD and Hemp practice for a webinar addressing a range of topics targeted to businesses, new ventures and investors; municipalities; and employers, including how to recognize and train managers on signs of cannabis impairment, recommended changes to drug and alcohol testing policies and tips to make expectations clear and avoid legal exposure.

For additional details on topics covered and to register for this free webinar, please visit our website.