Upcoming 2021 Municipal Revaluations in Connecticut & Other Important Property Tax Deadlines for Manufacturers

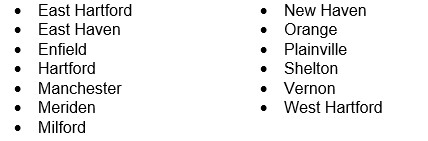

Forty Connecticut municipalities are scheduled to conduct real property revaluations effective October 1, 2021. The following is a partial list of some larger municipalities undergoing a revaluation this year, which are home to a number of manufacturing facilities:

A revaluation notice containing the proposed new assessment of your real property will be mailed in the latter part of this year. The notice usually will include an invitation to attend an informal hearing with the revaluation company or the assessor’s office to discuss the new assessment, which should represent 70 percent of the fair market value of your real estate.

If these discussions do not succeed, the deadline for formally protesting an assessment to a municipality’s board of assessment appeals is February 20, 2022, although some communities may extend the date to March 20, 2022. This protest is required in order to file a Superior Court tax appeal challenging value. Under certain circumstances, a tenant responsible for taxes can file the appeal.

In addition to the upcoming municipal revaluations for real estate, the filing deadline for the annual personal property declarations is November 1, 2021. Manufacturers should keep in mind that certain machinery and equipment used in their manufacturing process may be eligible for an exemption from personal property taxes. To receive an exemption for any qualifying assets, you will need to complete and timely file both a personal property declaration and M-65 form by the November 1st deadline. Declarations and M-65 forms should be available on your municipality’s website.

Should you have any questions or require assistance with any step of the revaluation process, the attorneys and paralegals of Pullman & Comley’s Property Tax and Valuation Department have substantial experience in this field.